https://www.kctv5.com/2023/06/25/cla...y-assessments/

Quote:

KANSAS CITY, Mo. (KCTV) - A new class action lawsuit challenges the quality of Jackson County’s property assessment. It calls into question if some increases are even legal considering some notices came in the mail after the June 15 deadline, as required by state statutes.

The filing asks a judge to step in and offer injunctive relief. It also calls for a jury trial.

The lawsuit was filed by attorney and developer Ken McClain on behalf of Trevor and Amanda Tilton of Odessa and two businesses.

The lawsuit is critical of the methodology used by Jackson County to reach new values. It argues the newly-built assessment system fails to include sufficient information and there’s a lack of physical inspections.

It points out assessments should consider current market conditions. It argues that didn’t happen when it came to commercial property.

The lawsuit claims Jackson County uniformly increased the value of every non-vacant commercial property with an improvement by 25%. And vacant commercial properties had an across-the-board increase of roughly 50%.

KCTV5 has heard from numerous homeowners who are shocked by the large increases in their assessments. Some question if they’ll be able to keep their homes. They also question if they can realistically sell when property tax assessments increase so much in one fell swoop.

READ MORE: Jackson County property assessment workshops kick off

There has been a 30% average increase in Jackson County. The Assessor’s Office argues homeowners are seeing large increases because Jackson County real estate has not been assessed with Fair Market Valuations (FMV) for a long time and building costs have increased.

The lawsuit is filed against Jackson County Executive Frank White, Assessor Gail McCann Beatty and other members of the Board of Equalization.

KCTV5 reached out to Jackson County’s public information officer for comment but we have not heard back yet.

|

Politicans exempt from insane take hikes

Legislation drawn to overturn insane tax hikes:

Protest scheduled at Jackson County Courthouse:

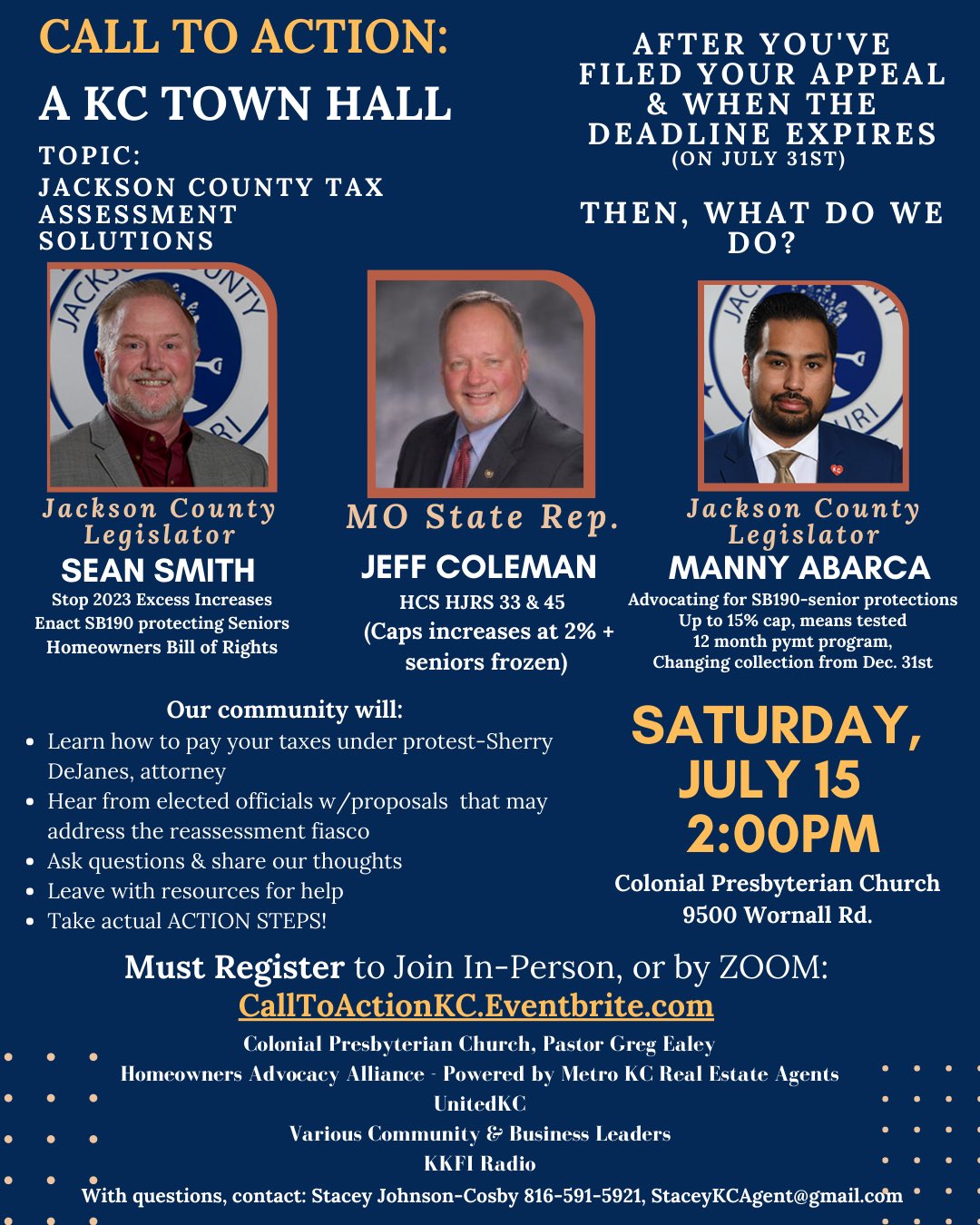

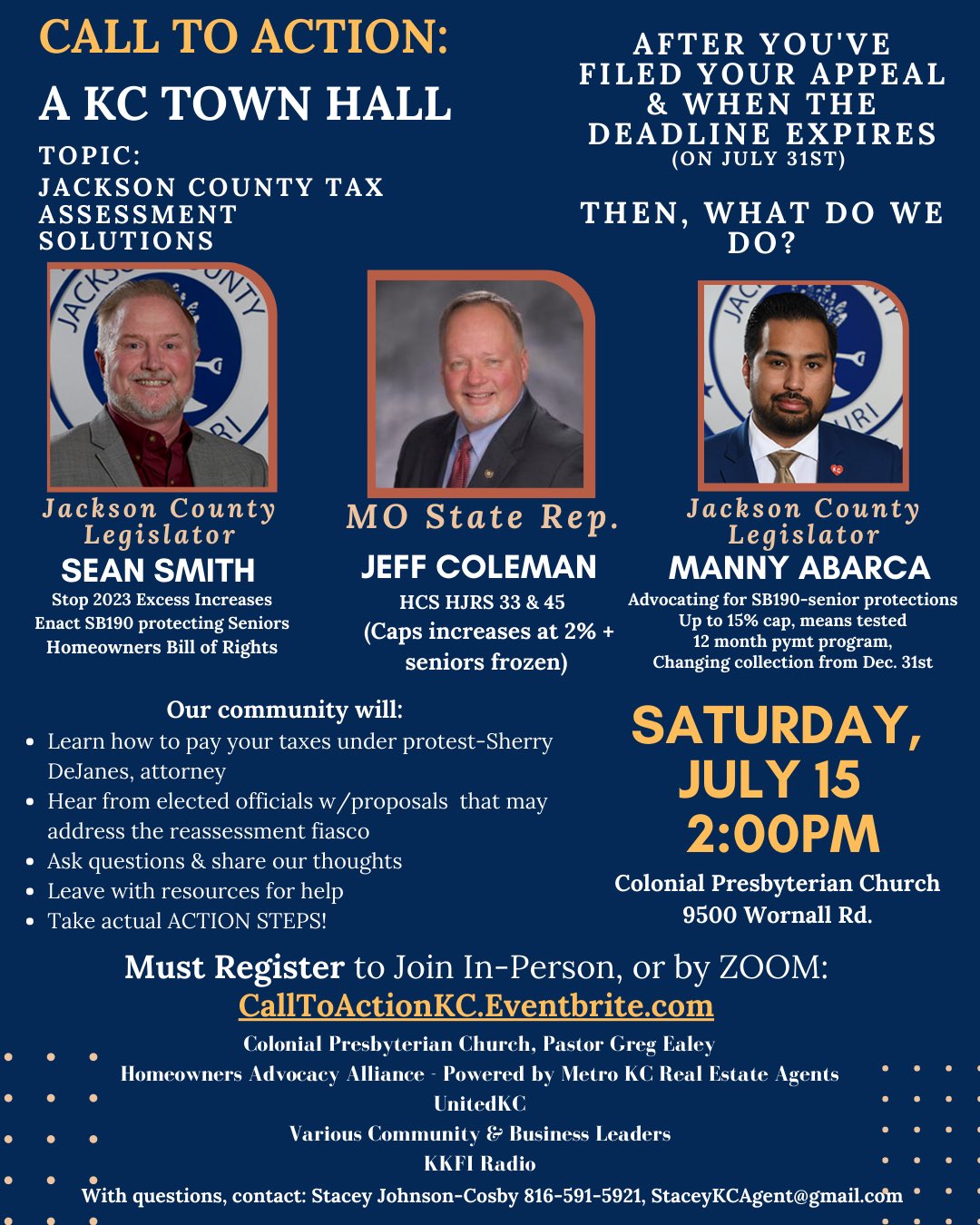

KC Town Hall scheduled July 15