|

|

|

|

||

|

I'll be back.

Join Date: Nov 2002

Casino cash: $4350478

|

Class action lawsuit filed over Jackson County assessments

https://www.kctv5.com/2023/06/25/cla...y-assessments/

Quote:

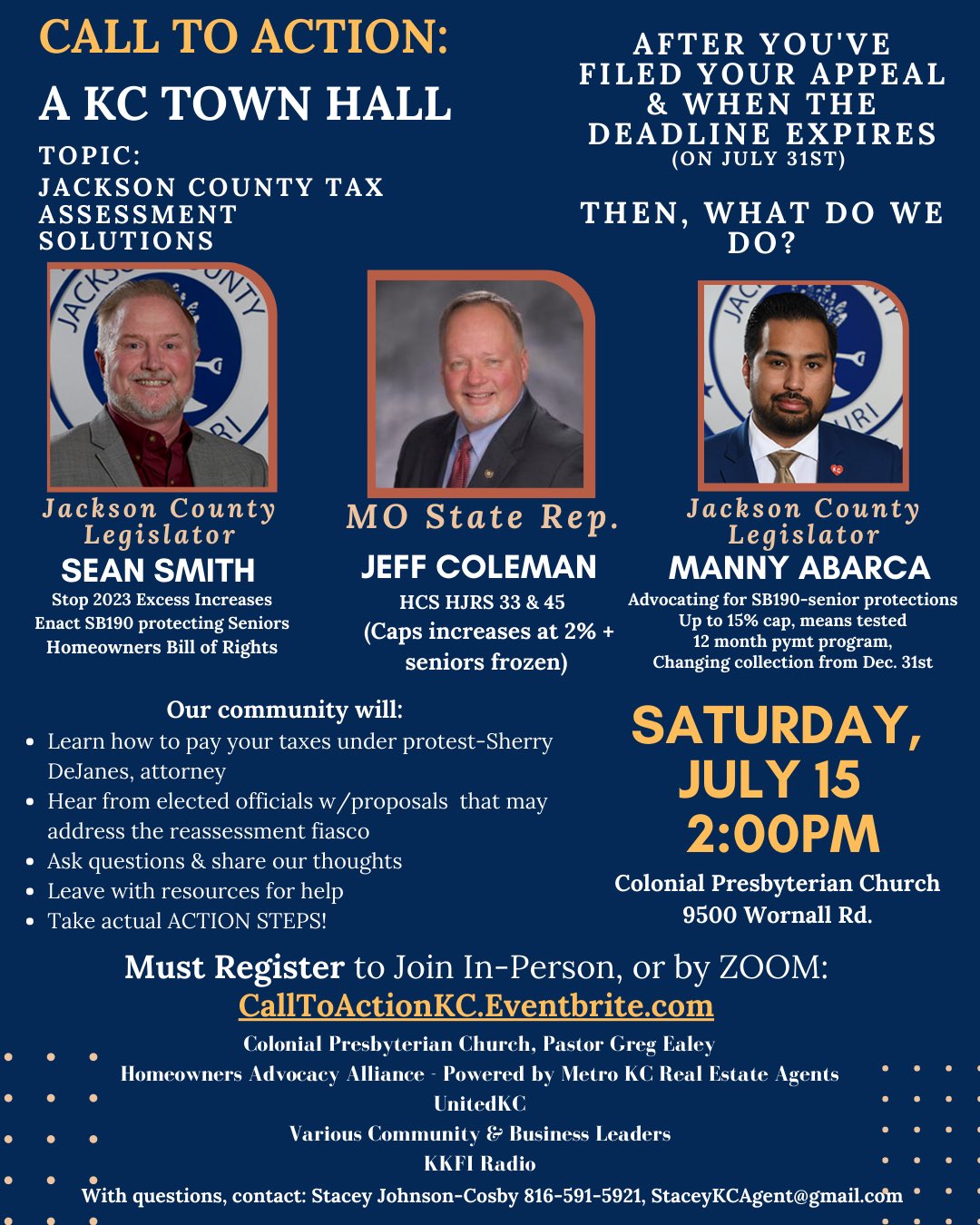

Legislation drawn to overturn insane tax hikes:  Protest scheduled at Jackson County Courthouse:  KC Town Hall scheduled July 15  Last edited by Hammock Parties; 07-09-2023 at 07:57 AM.. |

|

|

Posts: 278,935

|

|

|

|

#196 |

|

I'll be back.

Join Date: Nov 2002

Casino cash: $4350478

|

As the thread has now gotten cluttered with trolling, here are the latest updates:

Politicans exempt from insane take hikes  Legislation drawn to overturn insane tax hikes:  Protest scheduled at Jackson County Courthouse:

__________________

Chiefs game films |

|

Posts: 278,935

|

|

|

|

#197 |

|

Supporter

Join Date: Mar 2003

Casino cash: $2837626

|

You could stop lying.

|

|

Posts: 16,452

|

|

|

|

#198 |

|

Has a particular set of skills

Join Date: Dec 2003

Location: On the water

Casino cash: $2779627

|

In this thread there has been feedback that the same thing is happening nationwide. There ain’t enough commies to commit this heinous act on god fearing Americans.

__________________

Time is worth more than money. |

|

Posts: 79,266

|

|

|

|

#199 |

|

C Chiefs once a year!

Join Date: Dec 2012

Location: Cali

Casino cash: $2056097

|

|

|

Posts: 7,608

|

|

|

|

#200 |

|

C Chiefs once a year!

Join Date: Dec 2012

Location: Cali

Casino cash: $2056097

|

|

|

Posts: 7,608

|

|

|

|

#201 | |

|

I'll be back.

Join Date: Nov 2002

Casino cash: $4350478

|

Seems fine!

Quote:

__________________

Chiefs game films |

|

|

Posts: 278,935

|

|

|

|

#202 |

|

Supporter

Join Date: May 2005

Location: Who knows?

Casino cash: $2565884

|

JFC

|

|

Posts: 83,617

|

|

|

|

#203 | ||

|

Needs more middle fingers

Join Date: Mar 2005

Location: San Diego

Casino cash: $4024563

|

Quote:

Quote:

__________________

Life is like a dick. Sometimes it gets hard for no reason, but it can't stay hard forever. |

||

|

Posts: 64,593

|

|

|

|

#204 | |

|

Needs more middle fingers

Join Date: Mar 2005

Location: San Diego

Casino cash: $4024563

|

Quote:

__________________

Life is like a dick. Sometimes it gets hard for no reason, but it can't stay hard forever. |

|

|

Posts: 64,593

|

|

|

|

#205 |

|

C Chiefs once a year!

Join Date: Dec 2012

Location: Cali

Casino cash: $2056097

|

Well prop 13 has saved us from going through this fiasco. I still hate the .0019% school measure bonds etc I see on my property tax bill. There are 3 of them on my bill + others.

|

|

Posts: 7,608

|

|

|

|

#206 | |

|

M-I-Z-Z-O-U

Join Date: Apr 2001

Location: Kansas City

Casino cash: $1400308

|

Quote:

Some areas didnít get reviewed in 19 when the county last did this. We got hit then and went to a pretty fair market value. The issue is that on top of that, people are being assessed at crazy, arbitrary values that are not in line with sale prices. Mine increased 44 percent (after increasing in 21, too) , and put it at 125,000 clear of what 2 similar SF homes on my literal block have sold for in the past two months. I didnít squawk when the increase happened in 19. It was fair. This is not a fair assessment. There are lots of people with that issue. And Iím sure some whose homes were drastically undervalued for assessment purposes

__________________

"You gotta love livin', cause dying is a pain in the ass." ---- Sinatra |

|

|

Posts: 21,166

|

|

|

|

#207 |

|

Starter

Join Date: Mar 2021

Casino cash: $4440400

|

A friend had an appt with the County and sat before Tyler Technologies employees (the flounders responsible for the mass appraisals) and went over the appraisal she has performed. She inherited the home from her father that has the home rebuilt in 1993 after a fire. She had interior pics from the appraisal, but they kept hammering her on things like "are you sure there isn't a new stove?!". They were $100+K over the appraisal and they

were arguing over a stove! If you have a challenge appt. nake sure you have pics of deficiencies, dated decor, and functional obsolescences (ceilings less than 8', bedrooms without hall access, floor levels with no bath etc). From what she gathered, Jackson Co. spent $19mm on Tyler Tech, which is why they had to sent employees to KC to CYA the fiasco. |

|

Posts: 850

|

|

|

|

#208 | |

|

Ultrabanned

Join Date: Oct 2007

Location: KCMO

Casino cash: $1659356

|

Quote:

|

|

|

Posts: 40,641

|

|

|

|

#209 | |

|

I'll be back.

Join Date: Nov 2002

Casino cash: $4350478

|

here we go

As Jackson County property tax appeal deadline looms, one group is taking action Quote:

__________________

Chiefs game films |

|

|

Posts: 278,935

|

|

|

|

#210 | |

|

MVP

Join Date: Aug 2017

Casino cash: $4850400

|

Quote:

__________________

I ask who are the militia? They consist now of the whole people, except a few public officers." - George Mason "Be my brother or Iíll kill you." Nicolas Chamfort Sťbastien-Roch, on the French Revolutionary principle of fraternity "Art, like morality, consists in drawing the line somewhere." GK Chesterton "It is our true policy to steer clear of permanent alliance with any portion of the foreign world." FAREWELL ADDRESS, 1796 |

|

|

Posts: 13,822

|

|

|

|

|